2020 Client Base Trends

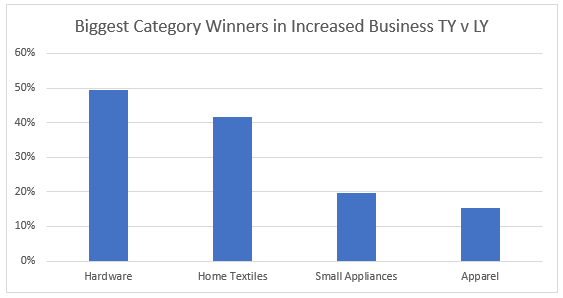

Despite the tragedy that was 2020, the ERS customer base experienced a 16% increase in sales year over year*. That’s not to say everyone saw an increase, but strong gains in Home Textiles, Home Decor, Small Appliances and Toys led the way. Even our apparel clients managed an increase. At first that was a surprise- but given that the apparel manufacturers who work with us are engaged in constantly using POS data to manage their inventory and make better merchandising decisions– it makes sense.

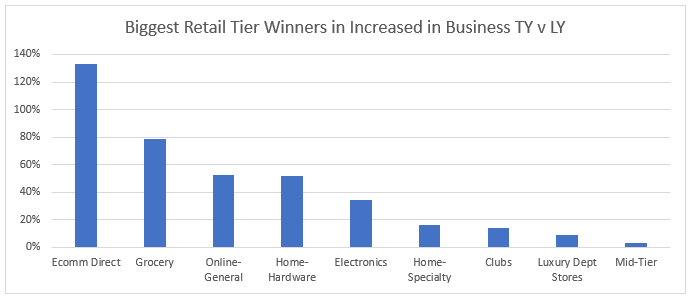

What’s more dramatic is the shift in where the sales were generated. No surprise here, online contributed to most of the gains. The “we sell absolutely everything and deliver it to your door in 2 days” retailer generated 52% more business. More interesting is that the specialty driven online retailers and manufacturer drop ship business was up 133%. Many of our clients opted to maintain their own inventory and list items in dozens of smaller online retailers. That strategy paid off for them.

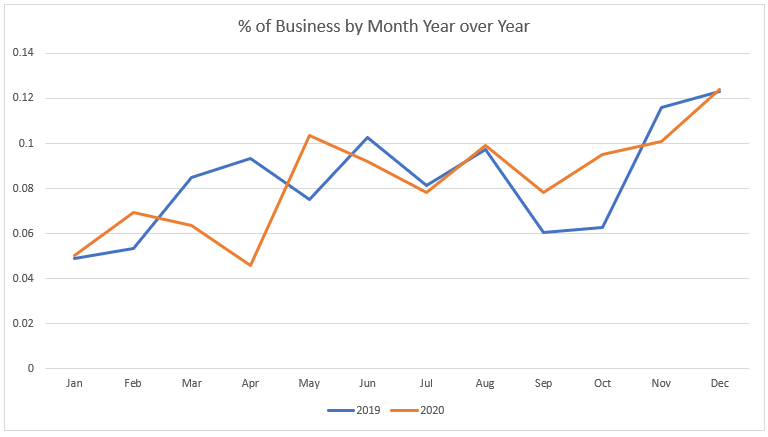

There’s been a lot of chatter about the death of Black Friday, and the sales from our client base back that up. 2020 saw an increase in the percentage of business August through October compared to 2019. And in 2019, there was a much more dramatic lift in sales from October to November. That could be promotion driven or consumers were just afraid there wouldn’t be merchandise for them to buy in November and December.

We know many retailers bought conservatively, which is not unreasonable given the uncertain environment. It also explains why the drop ship business was so dramatically increased. In key home categories such as throws and decorative accessories inventory was depleted within 30 days- and significant business was lost. Learning to manage inventory in the drop ship world will be part of the new normal (we can help).

With vaccines starting to be administered we hope to see the economy start to reopen, but I think it’s still a few months away. And as the politics of stimulus play out, we’ll need consumer confidence to remain steady to see retail fare better in 2021.

What lessons did we learn in 2020? Watch the numbers more closely- track trends between brick and mortar and online. Offer newness. Study your price elasticity– some clients sold great product at full price, others held on to the promotional side of the business. Re-think country of origin and how to move product through your supply chain. It was a real test for US brands and their relationships with overseas factories. Most important- thank and continue to praise the first responders, health care workers, teachers, delivery drivers and small shop owners who kept the American consumer alive this year.

* Based on clients with 24 months of consistent sales data.

Comments are closed