By Jim Lewis, CEO Enhanced Retail Solutions LLC

I recently attended Toy air in NYC. It was great to catch up with clients and prospects. But the best part was seeing all the incredible products. The toy industry has always been very innovative and this year was no exception. I felt there was a good balance between electronic/video products and good old fashioned tactile card and board games.

Most people I spoke to were optimistic about the industry. But in all honesty, it’s hard not to be when you’re surrounded by great toys. Not so thrilled about only having a handful of retailers that control the vast majority of the market. Getting and holding on to that business- especially at Walmart- is a challenge for brands that don’t have the Lego or Barbie logo on it.

Play is a serious business- most companies I talked to ask the same question- how do you think holiday will go? Its hard to tell. The government talks about inflation coming under control, yet people aren’t buying strawberries at the grocery store because they are too expensive. The economy is still troubling for many consumers so I think spending will be less. AT the same time though, consumers generally don’t skimp when buying for their kids. Well priced toys and promotions from Amazon, Target and Walmart could make the season equal to or slightly higher than last year. That’s my prediction.

The next question revolved around inventory management. If holiday is not good, retailers and suppliers will have to unload unsold inventory in the spring, giving up profit. Several companies I met with are having great success and focused on the end of the inventory spectrum- not having enough, and how to compensate for lost sales. Now that’s a question I’ve answered at nauseum.

Estimating Lost Sales

I know I sound like a broken record, but if you are not tracking lost sales and adding it back into your basis for forecasting you are missing the boat. It’s a mutual win for both suppliers and retailers. No one wants to leave money on the table. It’s tedious work but we have great tools to help you do it. It can be done for both brick and mortar or ecommerce, although the algorithms are different.

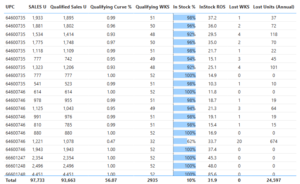

For brick & mortar you need to track on hand and sales by location by week. First, determine a rate of sale for when a sku is in stock. Then count out of stock weeks and multiply it by the rate of sale. Simple. That’s basically what you could have sold if you were in stock. But when working with chains with thousands of stores, and thousands of sku’s, Excel is not the best tool to use. The image below shows our lost sales dashboard in Power BI.

Inventory tracking by store and lost sales calculator

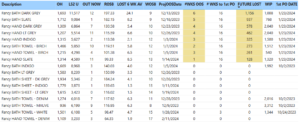

For ecommerce the premise is the same but the calculations are a bit different. It can get tricky if there’s shared inventory but the concept is to look at the inventory and sales week to week and if inventory drops below a specified threshold, then lost sales are assumed. We call this qualified sales and inventory and that’s also how we build ecommerce forecasts.

Determining lost sales for ecommerce business

Estimating Future Lost Sales

The last 2 examples show what was missed in the past. But what if you are going to be out of stock for some period of time? You can use the same rate of sale- adjust for seasonality if necessary and then figure out how many weeks it’s going to be until you’re back in stock. We’ve automated that as well. The example below shows much business will be lost until the next order arrives. This is helpful in determining total potential of a sku.

Estimating future lost sales

Comments are closed